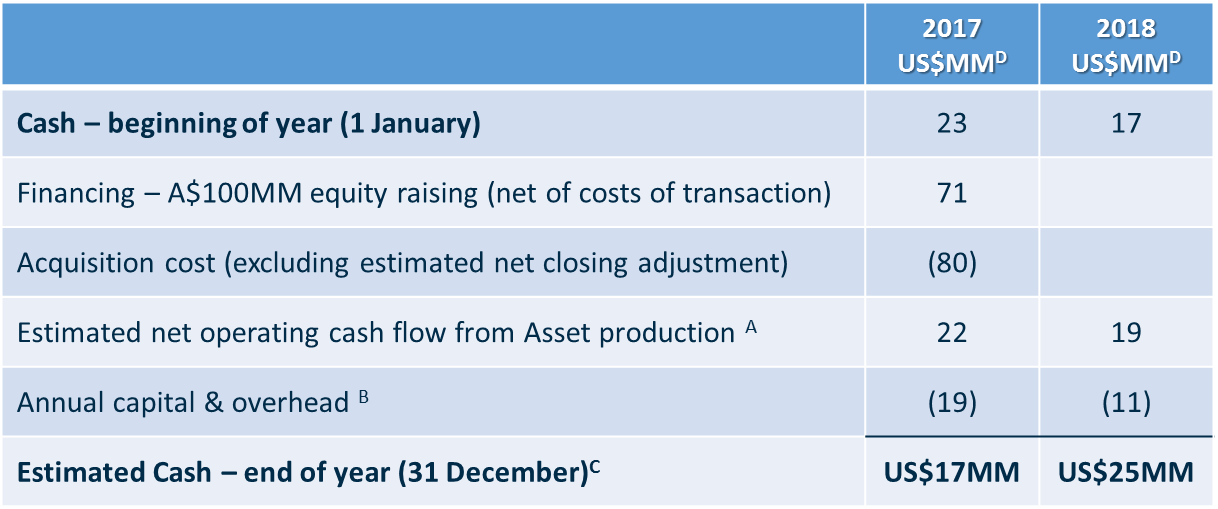

The following table and notes outline our anticipated cash flow through to the end of 2018 with a base case land program.

A) Based on the Ryder Scott report for production, revenue, royalties, taxes and field operating costs the 11 month period to 31 December 2017 and calendar year 2018. Revenue is based on the forward strip oil pricing as at the effective date of their report of 1 February 2017

B) The capital & overhead budget assumes successful completion of the 2017 and 2018 leasing renewal program on Australis’ existing leases and leasehold areas acquired from Encana and in 2017 the anticipated purchase price adjustment. The majority of the capital budget is discretionary expenditure. The capital budget does not include any drilling operations.

C) The estimated cash as at each year ends are estimates only. Please refer to the risks and disclaimer sections contained within this Presentation.

D) Exchange rate A$1.00 = US$0.75

This leaves capacity for drilling operations nominally in 2018, with locations identified where Australis would retain only a 30 – 40% working interest.

The large acreage position that Australis will hold, with a considerable time period remaining on leases, provides significant currency for Australis to utilise when sourcing and negotiating with other parties to help fund forward activity.

The Encana project has producing assets, which will give us ongoing cashflow with which to continue development work.