Valuation Metrics

Buying oil production at a discount to Net Present Value, with additional value and growth potential from a large inventory of future locations

What is the price for this asset? Does it represent good value for the company?

The acquisition price is US$80 million with an adjustment at close due to net revenue and other costs for the period between the effective and closing dates, ie 1 November 2016 and mid-April 2017.

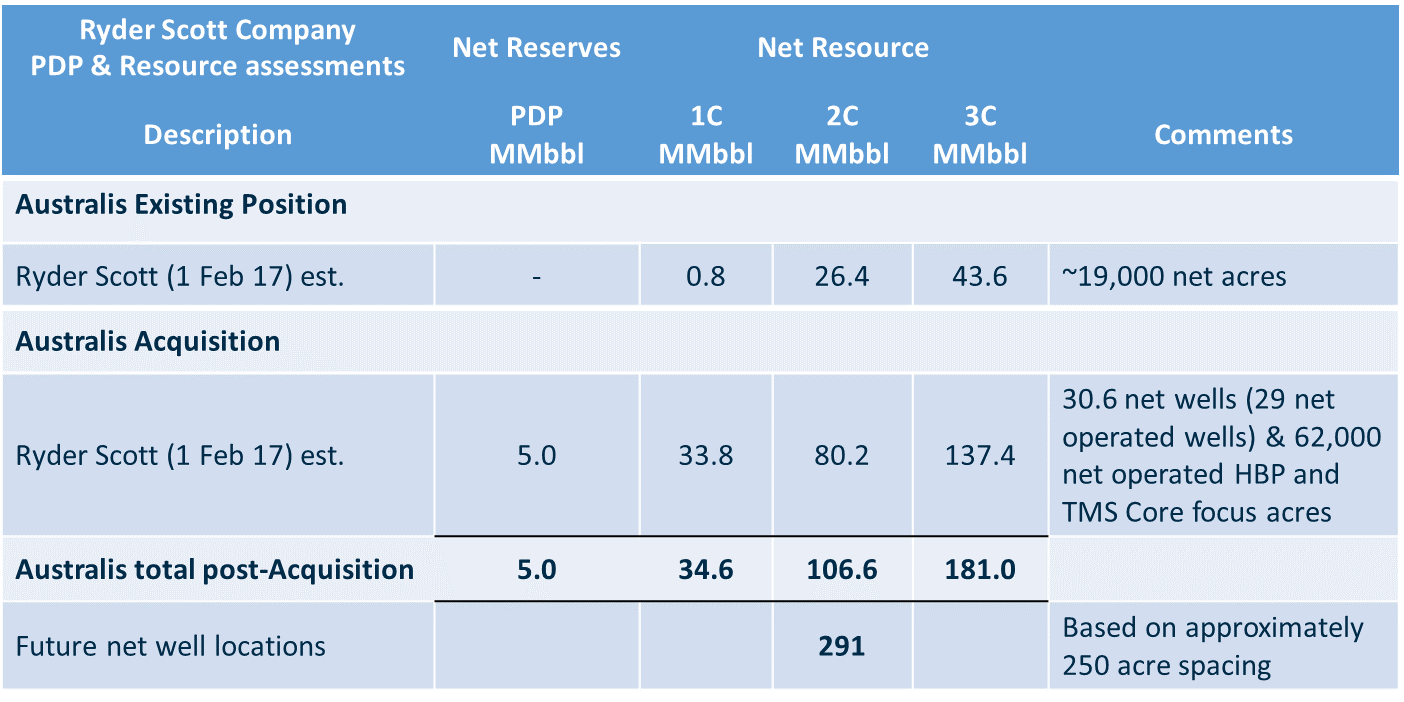

Ryder Scott have provided the following assessment of reserves and resources associated with the existing and acquired positions in the TMS

We believe the assets represent attractive value for Australis. The acquisition is being made in a counter cyclical environment. There is significant upside from the entry price point, with nominal valuations on the acquisition as follows:

• Proved Developed Producing (PDP) at US$95 million – (at pre tax NPV10)

• Proved Developed Producing (PDP) at US$69 million – (at pre tax NPV20) – used for land value allocation

• HBP core acreage at US$8 million

• Focus core acreage at US$3 million [Read more]

The acquisition has attractive metrics, including:

• US$ 36,316/flowing bbl

• US$13.53/bbl PDP reserve

• US$0.14/bbl 2C resource

As well as the existing production of 1,900 bbls/d and a PDP of 5 million bbls, the acreage provides a large inventory of potential future drilling locations (total post acquisition of 291), which provide a platform for significant growth in the future. The existing cash flow and this inventory of future locations provides increased funding flexibility.