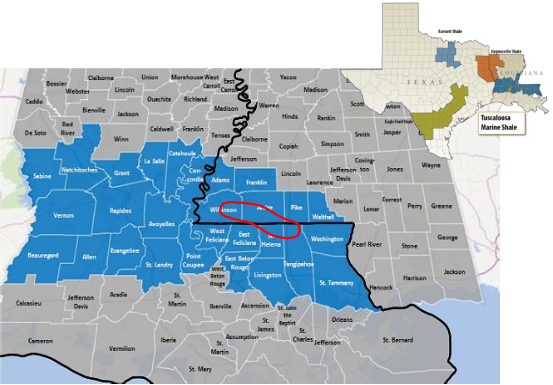

The TMS has a cretaceous shallow marine deposition similar to the other unconventional plays along the gulf of mexico coastline. As the ‘acreage land grab’ commenced with initial interest in the play, there were mixed productivity results. The TMS extends over a large area as shown in blue on the map below. Early activity delineated a core area that had very promising results but it was clear that well performance outside of this area, shown in red on the map below, demonstrated low productivity. In 2014 more wells were drilled within the core and they delivered strong productivity results whilst at the same time drilling and completion operations were becoming more consistent. And then in 2015, the falling oil prices meant a weaker environment for investment and development in this emerging unconventional shale play.

[Read more]

Initial participants in the play either withdrew as they realised that their acreage positions were outside of the core area or were poorly funded for the new environment post oil price fall in late 2014.

Our research on analysing drilling and completion data, production results and reserves to date has led us to believe that the core of the TMS is the ‘sweet spot’ of the entire play.

We believe a great opportunity to maximise returns on investment lies within an undeveloped play – of which there are only a few left.